MicroStrategy, the giant corporate bitcoin holder that is now called “Strategy”, is expanding its already huge bitcoin purchasing plan. It announced plans to raise $84 billion over the next 2 years — all to buy even more bitcoin.

The new plan is called the “42/42 Capital Plan” and will raise $42 billion from stock sales and another $42 billion from debt to grow their already massive bitcoin holdings.

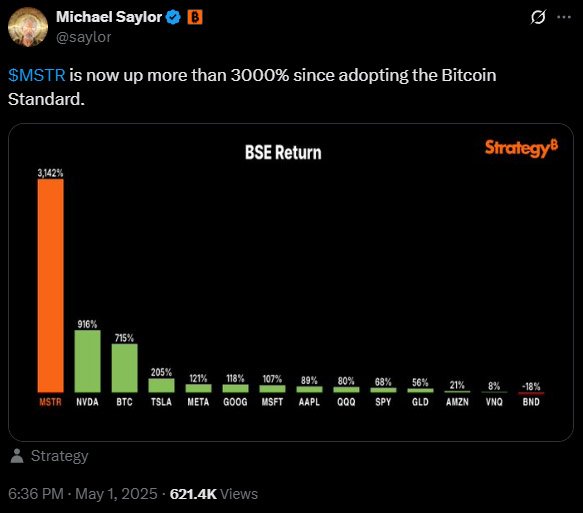

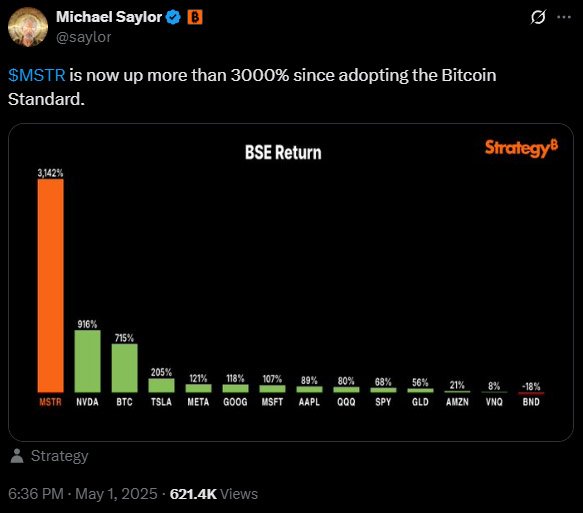

Strategy started as a software company, but in the last few years they have shifted their main focus to Bitcoin. Their chairman and former CEO, Michael Saylor, is a big Bitcoin advocate and is leading the charge in making the company the largest corporate holder of the scarce digital asset.

In fact, it already owns over 553,000 BTC purchased for $37.9 billion, at an average price of $68,500 per bitcoin. At current prices those holdings are over 40% in profit.

Saylor said it’s all about Bitcoin, it’s the future of digital assets and their capital plan supports that.

The “42/42 Plan” is an upgrade from the previous “21/21 Plan” which was launched just six months ago. The plan was to raise $21 billion in equity and $21 billion in fixed-income securities. But now the company is doubling down.

As of May 1, the company has about $128 million left to issue under the existing equity program and $14.6 billion in debt outstanding from earlier offerings.

Strategy posted a Q1 2025 net loss of $4.2 billion, or $16.49 per share. Analysts say it’s mostly due to new accounting rules that require companies to report unrealized gains and losses from bitcoin on their balance sheet.

Related: FASB’s New Bitcoin Accounting Rules Now in Effect

But Strategy is still optimistic.

The firm raised its 2025 Bitcoin Yield target from 15% to 25% and 2025 Bitcoin dollar gain from $10 billion to $15 billion. This shows it sees bitcoin as more than a hedge, and more like a big source of profit.

“We like MSTR as the most scalable bitcoin vehicle,” wrote Bernstein in an analysis. “tapping into large institutional pools unable to access Bitcoin/spot ETFs.”

Despite the losses, MSTR stock held up well. After the earnings call, the stock rose 3% and was trading around $394.87. Analysts say this is a sign investors still believe in its long-term plan.

Benchmark’s Mark Palmer said MSTR now trades at 2.13 times net asset value, calling it an “attractive number” given how they grow shareholder value through bitcoin.

Palmer said the company’s first-mover advantage and scale still stand out even during bitcoin’s volatile price actions. “Strategy reminded us of the extent of their first mover advantage,” he said.

Over 70 companies now have some form of bitcoin program but Strategy is still far ahead in terms of size and commitment. Their bitcoin stash is about 2.63% of all bitcoin in existence, a remarkable number for a public company.

Strategy is also experimenting with new financial tools like preferred stock offerings (STRK and STRF) and will continue to develop products for various investors worldwide.