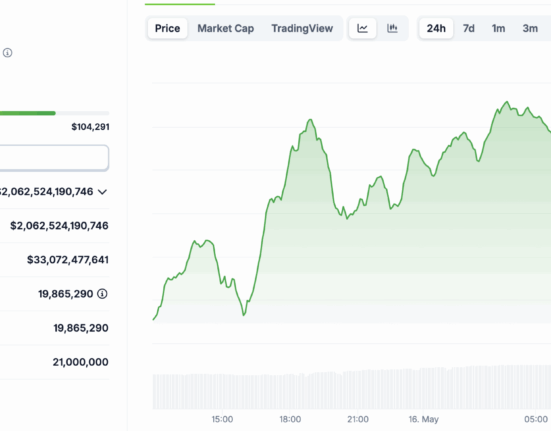

After last week’s triumphant surge past $100,000 following the promising news for a trade deal between the US and China, the current one began with another leg up for bitcoin but there was no all-time high despite the growing hopes.

The meeting between the two great powers took place during the weekend, and they jointly announced a tariff reduction and a pause on Monday morning. This had an immediate impact on BTC’s price, which jumped past $105,000 and neared $106,000 for the first time since January.

However, the asset faced a violent rejection at this point, and the bears pushed it south to under $101,000. Nevertheless, it managed to remain within a six-digit price territory and has stuck here ever since it broke above it on May 8.

More volatility was expected on Tuesday as the US CPI numbers came out. Although they were slightly better than expected, which raises the possibility of an interest rate reduction this year, at least in the eyes of many, BTC’s price remained relatively flat as it has recovered to around $104,000.

That expected volatility arrived a few days later when bitcoin dropped to $101,500 on Thursday amid reports that long-term holders have begun to offload portions of their holdings. Nevertheless, BTC has recovered most losses and now sits close to $104,000 once again.

On a weekly scale, its performance is quite sluggish, unlike ETH, DOGE, and HYPE. All three have jumped by double-digits and now trade close to $2,600, $0.23, and $28, respectively.

PI also had a big week as it faced massive volatility before and after Pi Network’s major announcement, which wasn’t a Binance listing as many anticipated, but a designated $100 million investment fund.

Market Data

Market Cap: $3.447T | 24H Vol: $120B | BTC Dominance: 59.9%

BTC: $103,900 (+0.7%) | ETH: $2,586 (+11.7%) | XRP: $2.42 (+2.4%)

This Week’s Crypto Headlines You Can’t Miss

These 5 Altseason Indicators Are All in Alignment, Is it Go Time For Altcoins? As the title of this Market Update suggests, there has been an ongoing narrative in the cryptocurrency community that an altseason has finally started. This article lists five major indicators suggesting that this relatively short period in the market has begun.

Arthur Hayes Predicts Capital Controls Will Propel Bitcoin to $1M by 2028. The former BitMEX CEO remains confident that BTC will eventually surge to $1 million. In his latest iteration of this prediction, he reasoned that such a spectacular 10x surge from the current levels would become possible due to the looming capital controls in the United States.

Bitcoin Metrics Align for Extended Bull Run as Price Holds Above Six Figures: Analysts. Although many believe an altseason is upon us, there are some metrics suggesting that BTC should not be counted out yet. Vital signs, such as the growing realized capitalization as well as renewed capital inflows, hint that bitcoin’s run has just started and the asset is still very much in a bull cycle.

ETH Withdrawals Surge to $1.2B Weekly as Price Nears 3-Month High. Ethereum has turned the whole narrative around it upside down in the past few weeks, and investors have started to pull out massive quantities of ETH from exchanges instead of the recent sell-offs. Its price touched a multi-month peak this week even though it was stopped above $2,700, at least for now.

Retail Bitcoin Investors Are Returning — A Sign of Renewed Confidence? Although BTC’s price rallied hard in the months after the US elections, there was no actual retail hype, unlike previous cycles. Now, though, on-chain information claims that such smaller market participants have finally reemerged, which could mean more gains in the near future but also the nearing of the cycle’s top.

Bitcoin Whales Load Up 83K BTC as Retail Sells Off: $110K Price Target in Sight? The past few weeks have seen a substantial divergence in the overall behavior between whales and smaller investors. The former cohort has continued to accumulate, while the latter has sold off some of their holdings, perhaps to realize profits during BTC’s climb above $100,000.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Hype, and Solana – click here for the complete price analysis.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.