Key Takeaways

- Grayscale has filed to convert its Chainlink trust into an ETF listed on NYSE Arca under the ticker GLNK.

- The trust may allow staking LINK tokens for rewards once regulatory and tax conditions are met.

Share this article

Grayscale is aiming to turn its Chainlink vehicle into a spot exchange-traded fund.

The asset manager recently filed a Form S-1 with the SEC seeking to convert the Grayscale Chainlink Trust (LINK) into the Grayscale Chainlink Trust ETF, to be listed on NYSE Arca under the ticker GLNK.

The move depends on NYSE Arca’s proposed generic listing standards for commodity-based ETPs, filed in July, which would allow certain crypto products to list without case-by-case SEC approval. If adopted, Grayscale believes its LINK product would qualify.

The trust would hold LINK directly, with Coinbase Custody serving as custodian and BNY Mellon acting as administrator and transfer agent. Shares would be created and redeemed in blocks of 10,000, but for now only through cash transactions facilitated by third-party liquidity providers. In-kind LINK transfers could be added later if regulators sign off.

The filing also leaves the door open to staking LINK, subject to tax and regulatory clearance.

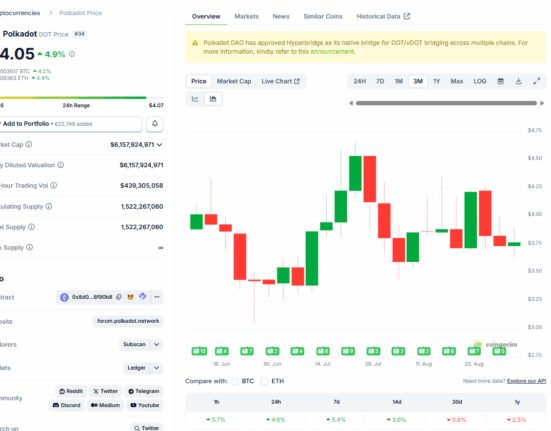

Chainlink currently sits at a $15.6 billion market cap, ranking it 13th among crypto assets, CoinGecko data shows. The token is trading at $23 at press time, climbing close to 3% on the day.

It’s not just Grayscale eyeing a LINK-backed ETF. In August, Bitwise Asset Management filed with the SEC to launch the Bitwise Chainlink ETF.

Share this article

Leave feedback about this