Will Crypto recover and why is everyone so dour about the outlook for the USA all the time? I like making fun of America but also think we’re all coping about that and the trajectory of

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

1.22%

Bitcoin

BTC

Price

$87,088.99

1.22% /24h

Volume in 24h

$29.98B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

.

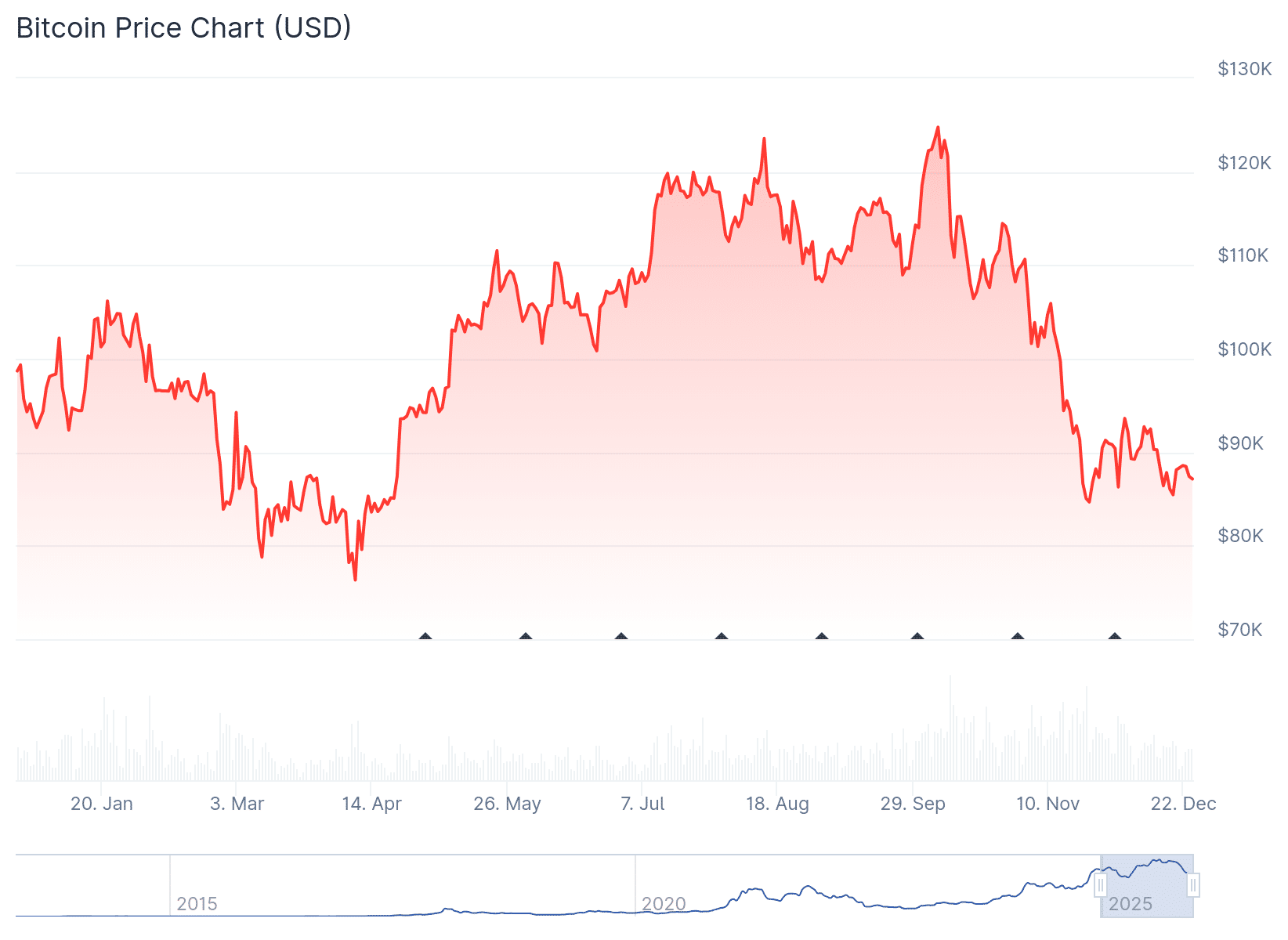

After weeks of selling pressure, the most honest question in crypto right now is not “when moon,” but whether a rebound is even plausible in the near term.

Bitcoin sliding from recent highs rattled confidence, flushed leverage, and reminded late-cycle bulls that crypto doesn’t go perpetually up. Yet what looks ugly on a chart does not automatically mean broken. In crypto, sideways is often the prelude, not the obituary. Here’s what to know:

DISCOVER: Top 20 Crypto to Buy in 2025

Will Crypto Recover? Bitcoin’s On-Chain Behavior Tells a Calmer Story Than Price

Crypto Fear and Greed Chart

1y

1m

1w

24h

Price action looks tired, but on-chain data suggests long-term holders are not panicking. According to Glassnode, long-term holder supply remains near cycle highs, while exchange balances continue to trend lower.

CoinGecko data shows Bitcoin’s market cap holding near $1.77T, with steady volume. This is not euphoric money flooding in, but it is also not capital sprinting for the exits.

DeFi Llama data reinforces the same theme. Total value locked across major chains has stabilized after months of contraction, implying capital is waiting, not fleeing.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The 2025–2026 Setup Still Favors Upside Patience

If there is a genuine threat to a crypto rebound, it is macro spillover. US equities, particularly AI-linked names like Nvidia, are carrying enormous expectations. When stocks sneeze, crypto still catches pneumonia. FRED data shows financial conditions remain restrictive, even as markets price in eventual rate cuts.

From a technical perspective, Bitcoin is trading below key EMAs, which keeps short-term structure neutral-to-bearish. That said, compression around the 20-day and 50-day EMAs historically precedes volatility expansion. The question is direction.

A lot of people have been asking for an update on this chart, so I’ll just leave this here for anyone who needs to see it.

This shows the average BTC trajectory following an oversold RSI reading, with RSI falling below 30 at t=0.

So far, it’s been pretty bang on.

Unless you… pic.twitter.com/FRLt5w7oFT— Julien Bittel, CFA (@BittelJulien) December 17, 2025

Support levels cluster tightly between $86,800 and $88,000. Resistance sits near $90,000, then $92,000. A clean reclaim of $90K with volume likely flips that sentiment fast.

Most forward-looking models still project Bitcoin retesting $100K–$110K by late 2025 if macro conditions stabilize. Supply remains structurally constrained and if ETF flows continue, even if uneven.

Crypto winters do not usually start with orderly consolidation. They start with panic. This feels like a shakeout that clears weak hands while stronger capital waits. Sideways, frustrating, and boring can still be bullish.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

Key Takeaways

- Price action looks tired, but on-chain data suggests long-term holders are not panicking.

- CoinGecko data shows Bitcoin’s market cap holding near $1.77T, with muted but steady volume.

The post Will Crypto Recover or Are We Stuck in the Chop Into 2026?? appeared first on 99Bitcoins.

Leave feedback about this